Lamar Promoting (NASDAQ:LAMR) shareholders have earned a 15% CAGR over the past 5 years

Inventory pickers are usually in search of shares that can outperform the broader market. And in our expertise, shopping for the fitting shares can provide your wealth a big enhance. For instance, the Lamar Promoting Firm (NASDAQ:LAMR) share worth is up 58% within the final 5 years, clearly besting the market return of round 42% (ignoring dividends). Nevertheless, newer returns have not been as spectacular as that, with the inventory returning simply 3.3% within the final yr , together with dividends .

So let’s examine and see if the long run efficiency of the corporate has been consistent with the underlying enterprise’ progress.

View our newest evaluation for Lamar Promoting

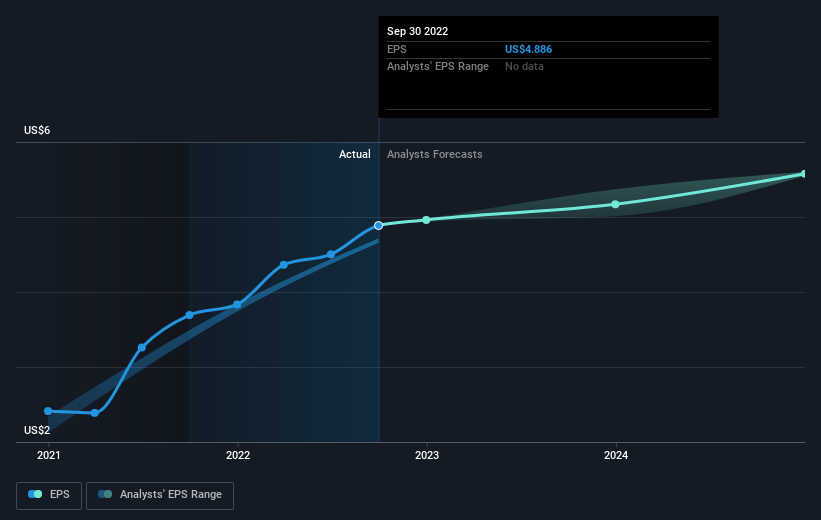

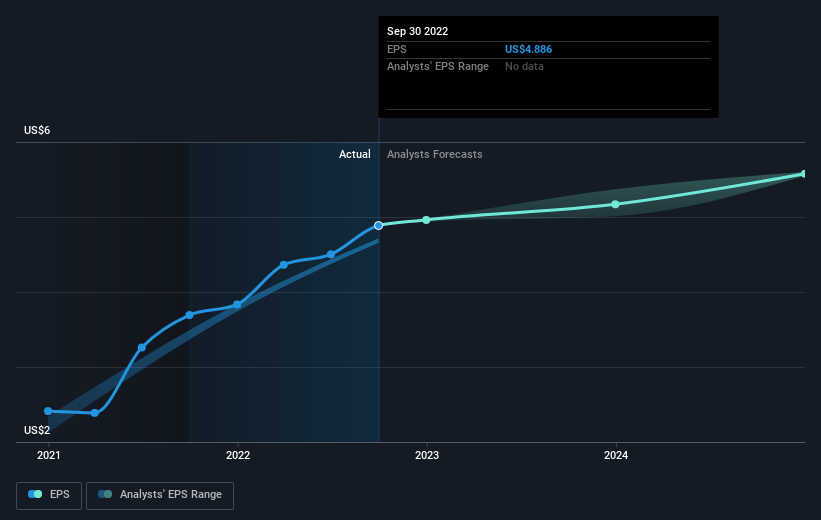

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t all the time rationally mirror the worth of a enterprise. By evaluating earnings per share (EPS) and share worth modifications over time, we will get a really feel for the way investor attitudes to an organization have morphed over time.

Over half a decade, Lamar Promoting managed to develop its earnings per share at 8.9% a yr. So the EPS progress price is relatively near the annualized share worth acquire of 10% per yr. This means that investor sentiment in the direction of the corporate has not modified an awesome deal. Certainly, it might seem the share worth is reacting to the EPS.

You’ll be able to see how EPS has modified over time within the picture under (click on on the chart to see the precise values).

It is most likely price noting that the CEO is paid lower than the median at comparable sized firms. However whereas CEO remuneration is all the time price checking, the actually essential query is whether or not the corporate can develop earnings going ahead. Earlier than shopping for or promoting a inventory, we all the time advocate a detailed examination of historic progress developments, accessible right here..

What About Dividends?

You will need to take into account the full shareholder return, in addition to the share worth return, for any given inventory. Whereas the share worth return solely displays the change within the share worth, the TSR consists of the worth of dividends (assuming they had been reinvested) and the advantage of any discounted capital elevating or spin-off. So for firms that pay a beneficiant dividend, the TSR is usually loads greater than the share worth return. We notice that for Lamar Promoting the TSR over the past 5 years was 98%, which is best than the share worth return talked about above. The dividends paid by the corporate have thusly boosted the complete shareholder return.

A Totally different Perspective

It is good to see that Lamar Promoting has rewarded shareholders with a complete shareholder return of three.3% within the final twelve months. And that does embrace the dividend. Nevertheless, that falls wanting the 15% TSR each year it has made for shareholders, every year, over 5 years. Potential consumers would possibly understandably really feel they’ve missed the chance, however it’s all the time doable enterprise continues to be firing on all cylinders. It is all the time fascinating to trace share worth efficiency over the long run. However to know Lamar Promoting higher, we have to take into account many different components. Take dangers, for instance – Lamar Promoting has 3 warning indicators we expect try to be conscious of.

In case you are like me, then you’ll not need to miss this free checklist of rising firms that insiders are shopping for.

Please notice, the market returns quoted on this article mirror the market weighted common returns of shares that presently commerce on US exchanges.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Lamar Promoting is doubtlessly over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Have suggestions on this text? Involved in regards to the content material? Get in contact with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary based mostly on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We goal to carry you long-term centered evaluation pushed by basic knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.